Increasing Fuel Prices

The Electric Vehicles Market is also being propelled by rising fuel prices, which are prompting consumers to seek more cost-effective transportation solutions. As gasoline prices fluctuate and often trend upwards, the total cost of ownership for electric vehicles becomes increasingly attractive. Data suggests that electric vehicle owners can save significantly on fuel costs, with some estimates indicating savings of over 1,000 dollars annually compared to traditional vehicles. This economic advantage is likely to drive more consumers towards electric vehicles, as they look to mitigate the impact of fuel price volatility. Consequently, the Electric Vehicles Industry stands to gain from this trend, as more individuals recognize the long-term financial benefits of switching to electric.

Rising Environmental Concerns

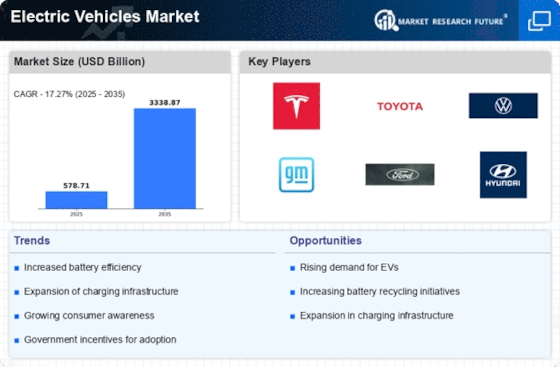

The Electric Vehicle Market is experiencing a surge in demand driven by increasing environmental awareness among consumers. As climate change becomes a pressing issue, individuals and organizations are seeking sustainable alternatives to traditional gasoline-powered vehicles. This shift is reflected in the growing number of electric vehicle registrations, which have reportedly increased by over 30% in the last year alone. Consumers are increasingly prioritizing eco-friendly options, leading to a significant transformation in purchasing behavior. The Electric Vehicles Market is thus positioned to benefit from this heightened consciousness, as more people recognize the environmental impact of their transportation choices. This trend is likely to continue, suggesting that the market will expand further as electric vehicles become synonymous with sustainability.

Economic Incentives and Subsidies

The Electric Vehicle Market is bolstered by various economic incentives and subsidies offered by governments worldwide. These financial incentives, which can include tax credits, rebates, and grants, are designed to lower the initial cost of electric vehicles, making them more accessible to a broader audience. For instance, some regions have reported that consumers can save up to 7,500 dollars on electric vehicle purchases due to these incentives. Such measures not only stimulate demand but also encourage manufacturers to invest in electric vehicle technology and production. As these economic incentives remain in place or expand, the Electric Vehicles Market is expected to experience robust growth, attracting new consumers who may have previously been deterred by higher upfront costs.

Advancements in Charging Technology

The Electric Vehicles Market is significantly influenced by advancements in charging technology. Innovations such as fast-charging stations and wireless charging solutions are enhancing the convenience of electric vehicle ownership. Recent data indicates that the number of fast-charging stations has doubled in the past two years, making it easier for consumers to transition to electric vehicles. These developments are also shaping the overall market size for electric vehicles, as improved infrastructure attracts a larger consumer base. This improvement in charging networks not only alleviates range anxiety but also encourages more consumers to consider electric vehicles as a viable option. As charging technology continues to evolve, the market size for electric vehicles is expected to expand further, driven by rising confidence in the practicality of electric vehicles for everyday use.

Enhanced Consumer Awareness and Education

The Electric Vehicles Market is benefiting from enhanced consumer awareness and education regarding electric vehicles. As information becomes more readily available through various channels, including social media, online platforms, and community events, potential buyers are becoming more informed about the advantages of electric vehicles. This increased knowledge encompasses not only environmental benefits, but also technological advancements and cost savings associated with electric vehicle ownership. Surveys indicate that a significant percentage of consumers are now aware of these advantages, contributing to a more favorable perception of the electric car market. As education efforts continue, the Electric Vehicles Market Sector is likely to see a sustained increase in consumer interest and adoption.